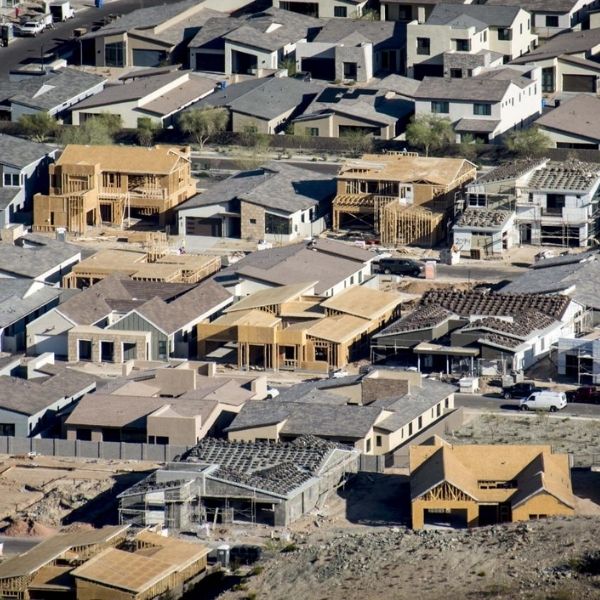

Arizona is unlikely to ever close its housing deficit, according to a new report released Tuesday by the Common Sense Institute (CSI).

The report shows Arizona is short by 56,047 housing units as of Q1 in fiscal year 2025. The state earned a “D” grade for its housing situation—down from a “C-” last year—due largely to a slowdown in housing permits.

Maricopa County, Arizona’s most populous region and home to Phoenix, also received a “D” for its ongoing housing challenges.

Although the housing deficit has shrunk from 68,742 units in 2019, the pace of permitting is slowing. CSI Chief Economist Zach Milne, the report’s author, said Arizona is projected to issue 47,539 building permits this year—a 20% drop from the 59,306 permits issued in 2024. That figure brings the state back to 2019 permit levels.

These permits, Milne explained, specifically refer to single-family home construction. He warned that the permitting slowdown could cause the housing shortage to grow worse.

A separate CSI report from May revealed it takes more than 300 days for new housing projects to navigate the full permitting and inspection process in Arizona.

To truly address the deficit, Milne emphasized, Arizona must build homes for both new population growth and existing residents. “We have a structural deficit in housing units that’s driven persistent and dramatic price increases,” he said.

In Q1 2025, the average monthly mortgage payment in Arizona hit $2,241, more than double the $1,045 average in 2019. The report also said home prices are 17% higher than they would be if pre-pandemic price trends had continued.

First-time buyers are being priced out of the market. According to CSI, the average Arizona household would now need to work over 65 hours a week to afford a mortgage.

While wages have risen, Milne noted that they haven’t kept pace with skyrocketing home values and high interest rates. This has made traditional 20% down payment mortgages unaffordable for many.

As of 2023, 88% of Arizona’s 90 cities and towns were facing housing shortages.

Milne said local governments could help ease the crisis by adjusting zoning rules, including minimum lot size requirements, which would make housing development faster and more affordable.

The report also pointed to a temporary shift in the market. With more sellers than buyers, prospective homeowners might see short-term price relief, but Milne cautioned this won’t last.

By the end of 2025, Phoenix-area home prices could fall by around 5%, the report estimates. However, the long-term outlook remains bleak. Arizona’s structural housing issues, the report concludes, will continue to make the market “unfavorable for future buyers.”

This article has been carefully fact-checked by our editorial team to ensure accuracy and eliminate any misleading information. We are committed to maintaining the highest standards of integrity in our content.

Leave a Reply