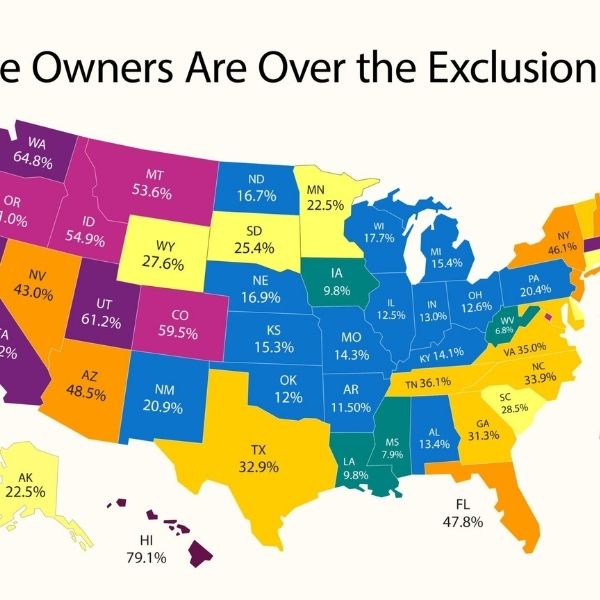

Colorado’s surging home values may come with an unexpected cost for sellers. A federal tax rule from 1997, untouched for nearly three decades, is catching up with today’s homeowners—and nearly 60% in Colorado could be hit with a hidden tax bill.

According to the National Association of REALTORS®, 59.5% of Colorado homeowners have exceeded the $250,000 capital gains exemption for individuals, while 18.2% have surpassed the $500,000 threshold for married couples. As prices rise in hot spots like Denver, Boulder, and Fort Collins, more sellers are facing tax consequences they never saw coming.

Home Values Soared—But the Tax Code Didn’t

Under current IRS rules, homeowners can exclude up to $250,000 in profits from the sale of a primary residence ($500,000 for married couples). But those limits haven’t been updated for inflation since 1997—when home values looked very different.

Since then, the average U.S. home price has jumped 260%, yet the exemption hasn’t budged. If adjusted, today’s thresholds would sit around $660,000 for individuals and $1.32 million for couples. In Colorado, many longtime owners now find themselves taxed on equity they built just by staying put.

Worse, Colorado taxes capital gains as regular income—adding the state’s 4.55% income tax on top of the federal rate. That combination can leave sellers with a surprise bill for tens of thousands of dollars.

It’s Not Just the Wealthy—It’s Everyone

This tax impact is no longer limited to luxury homeowners. Longtime residents in Colorado Springs, Fort Collins, and mountain towns are now at risk of owing capital gains on their home sale.

The situation hits hardest for:

-

Retirees downsizing

-

Families relocating for care or work

-

Empty nesters cashing in on decades of appreciation

Some homeowners only learn about the tax liability after listing their home. Others are skipping the sale entirely—what experts call a “stay-put penalty”, where tax fears lock up housing inventory and stall market movement.

Projections Show the Problem Will Worsen

Looking ahead, the numbers grow even more alarming. By 2035, projections show:

-

93% of Colorado homeowners will exceed the $250K exemption

-

72% will surpass the $500K threshold

That means nearly every homeowner in the state could face some form of capital gains tax unless the law changes. Economists warn this will trap equity, shrink housing inventory, and raise prices for buyers.

A Potential Solution: More Homes on the Market Act

To address the issue, real estate advocates are backing the More Homes on the Market Act, which would:

-

Double the current capital gains exclusions

-

Tie the limits to inflation going forward

“Equity shouldn’t be a trap. It should be a stepping stone for the next chapter,” said Shannon McGahn, Chief Advocacy Officer at NAR.

Until Congress acts, Colorado homeowners—especially those nearing retirement—are urged to consult a financial advisor before listing. In a high-growth market, careful planning could save tens of thousands.

Quick Tips for Colorado Sellers:

-

Know your basis: Track purchase price, major home improvements, and selling costs.

-

Time your sale wisely: If you’re close to the exemption threshold, careful timing may help avoid tax.

-

Consult a tax professional: Before listing, get advice tailored to your financial picture.

-

Watch for legislative updates: Tax changes may still be on the horizon.

If you’ve owned your home for a long time, built equity, and are thinking of selling—don’t let this tax surprise catch you off guard.

Leave a Reply