DENVER — More than 300,000 Coloradans who buy health insurance on the individual marketplace could see sharp premium increases if federal tax credits expire at the end of this year.

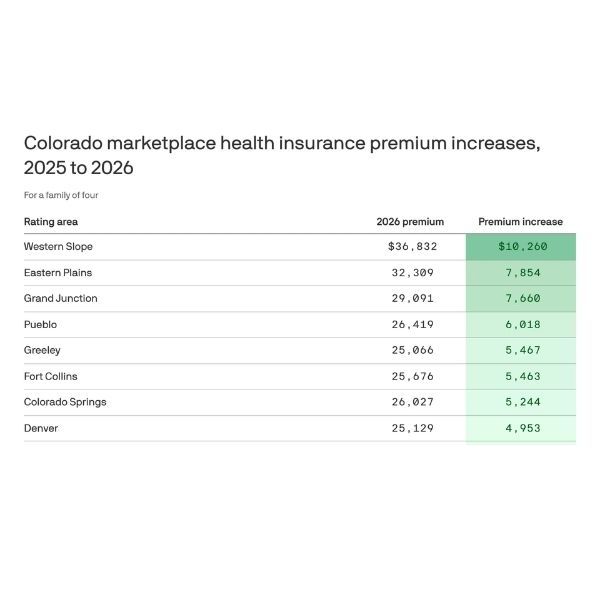

The Colorado Division of Insurance (DOI) projects average premiums will rise 28% statewide without the credits, with residents on the Western Slope facing a 38% jump. A 60-year-old in Denver could pay $2,869 more per year, while the same person on the Western Slope could pay $5,186 more.

U.S. Rep. Diana DeGette joined healthcare advocates in Denver Thursday, urging Congress to extend the credits when lawmakers return from recess in September. “This is not abstract. This is real life for millions of Americans,” she said.

Advocates warn the loss of subsidies will force many to delay or forgo care, disproportionately affecting immigrant families, low-income workers, and communities of color.

Rep. Lauren Boebert opposed extending the credits, calling them “runaway spending fueled by the Biden Administration” and arguing for alternative cost-cutting measures.

Gov. Jared Polis has asked state lawmakers to explore ways to offset the impact during a special legislative session.

For Coloradans like Chelsey Baker-Hauck, who relies on insurance to manage long COVID and a neurological condition, the stakes are personal. “We’ve already emptied our savings and my husband’s retirement. We’re really out of options,” she said, adding, “Healthcare should not be a partisan issue.”

This article has been carefully fact-checked by our editorial team to ensure accuracy and eliminate any misleading information. We are committed to maintaining the highest standards of integrity in our content.

Katie is a senior who has been on staff for three years. Her favorite type of stories to write is reviews and features. Katie’s favorite ice cream flavor is strawberry.

Leave a Reply